Table of Contents

How to read a balance sheet

The balance sheet. The balance sheet is a financial snapshot. It expresses the state of your organization’s assets, liabilities, and equity at a given point in time. The balance sheet, which is updat…

The balance sheet

The balance sheet is a financial snapshot. It expresses the state of your organization’s assets, liabilities, and equity at a given point in time. The balance sheet, which is updated in an ArtsPool member’s working budget each month, is a useful tool for assessing your current financial health and making year-over-year comparisons. This article aims to provide at-a-glance information to help interpret the balance sheet and answer common questions.

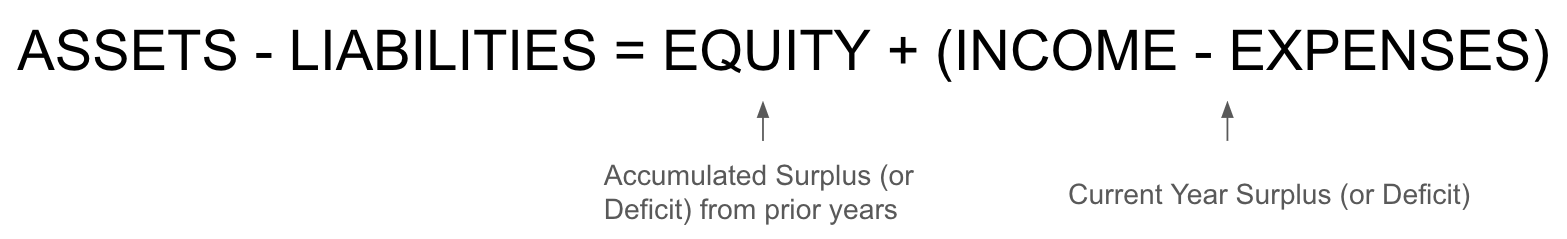

The accounting equation

The balance sheet is fundamentally tied to the process of double-entry bookkeeping employed by all modern businesses. Very briefly: the entire world of accounting fits within five fundamental types of accounts:

- ASSETS - things you own

- LIABILITIES - things you owe

- EQUITY - overall net worth (also called "net assets," more on this soon!)

- INCOME - increases the value of your accounts

- EXPENSES - decreases the value of your accounts

These accounts live in constant reference to one another. For instance, to determine your overall net worth, you subtract your liabilities from your assets. This is called the static accounting equation:

The balance sheet displays all of your organization's accounts according to this equation, slightly restated:

Your organization's income and expenses live inside this equation, too. Consider that you increase your net worth by receiving income (a paycheck, grant, etc.) and decrease your net worth by incurring expenses (salaries, rent, etc.). Thus, the "expanded" accounting equation can be stated as follows:

A company's total equity, then, equals its accumulated surplus (or deficit) since its inception plus its current year surplus or deficit.

Equity vs. Net Assets

So far, we've used the term "equity" to mean the net worth of your organization. You and your board members with experience in the for-profit sector are likely familiar with this term. If a company sold off all its assets and paid off all its liabilities, this remaining "equity" would be split among the company's shareholders. Nonprofits, however, do not have shareholders. So instead of "equity," we use the term "net assets" to describe our organization's net worth. Functionally, the terms are interchangeable.

Categorizing Net Assets

By law, nonprofits are required to respect restrictions imposed by donors or grant-making institutions on the resources they’re given. This is why nonprofits practice what’s called “fund accounting” - breaking down our equity accounts according to the restrictions (or lack thereof) imposed by donors and grant-makers. Prior to the FASB’s new Not-for-Profit Standard adoption in 2019, these categorizations were “unrestricted net assets,” “temporarily restricted net assets,” and “permanently restricted net assets.” Today, we group net assets into two broad categories: “net assets with donor restrictions” and “net assets without donor restrictions.” Specific subcategorization beneath these two headings is very common, for instance:

- Net Assets Without Donor Restrictions

- Undesignated

- Board-Designated

- Net Assets With Donor Restrictions

- Restricted for programs

- Restricted to the passage of time (i.e, temporarily restricted)

- Endowment (i.e., permanently restricted)

Returning now to the expanded accounting equation, we can bring this net asset terminology in to yield a more nuanced breakdown of our organization's equity:

![Equation: [ ASSETS - LIABILITIES = NET ASSETS WITHOUT DONOR RESTRICTIONS + (INCOME - EXPENSES) ] + NET ASSETS WITH DONOR RESTRICTIONS](https://files.helpdocs.io/4vlf1rrzi9/articles/yqh32yyl7i/1718131590176/screenshot-2024-06-11-at-2-46-21-pm.png)

According to this dynamic accounting equation, your organization's Net Assets Without Donor Restrictions represents its total accumulated surplus (or deficit) plus your "current year earnings (or losses)." Net Assets Without Donor Restrictions is a dynamic number that changes according to the moment you take this financial snapshot - the "as at" date at the top of your balance sheet.

Net Assets and cash

From this equation, we can also see that Net Assets are not strictly “cash.” Cash is indeed an asset, and when you earn new revenue via a cash payment (which would be categorized as an “income” transaction) there will be a corresponding increase to Net Assets. But nonprofits must use the Accrual Basis of Accounting, recognizing income when it is earned and expenses when they are incurred, not just when cash is exchanged. In these transactions (such as an organization receiving notice of a grant award, but not a check), this income is immediately recognized and a “receivable” asset is added to the books. This receivable increases an organization’s net assets without increasing the total cash on hand.

We must also recognize that some cash payments may be in fulfillment of pledges made with donor restrictions. We call this "restricted cash."

So, in short: not all Net Assets Without Donor Restrictions are Cash, and not all of an organization's Cash are Net Assets Without Donor Restrictions.

I don't care about accounting, show me the answers

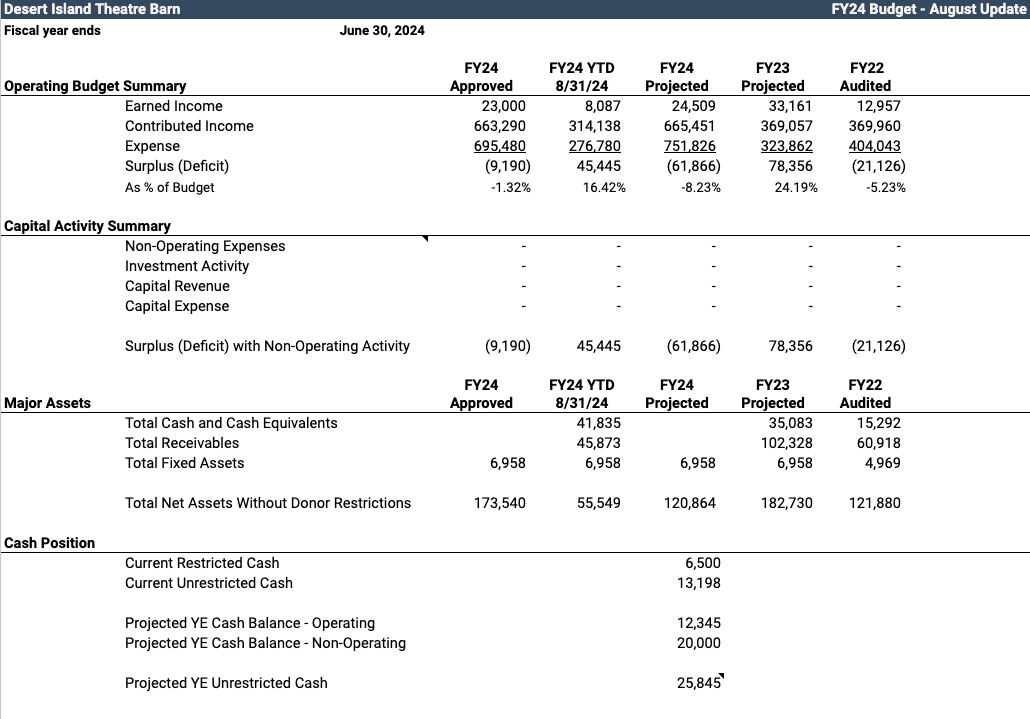

Fortunately for ArtsPool members, much of the key information provided by the Balance Sheet can be readily found on the Notes tab of your Working Budget, which is updated monthly.

- Total current cash-on-hand can be found under Major Assets, as "Total Cash and Cash Equivalents." This figure will include your checking and savings accounts, as well as other cash-holding accounts like PayPal, if your organization uses them.

- Total current Unrestricted Cash can be found under Cash Position, as "Current Unrestricted Cash." This figure will include cash in your bank account(s), less any cash received by the organization with donor restrictions.

- Total current Restricted Cash can be found under Cash Position, as "Current Restricted Cash." This is the amount of cash received by the organization with donor restrictions.

- A projected Year End Unrestricted Cash figure can be found under Cash Position. A more detailed breakdown of how it is projected that the organization will arrive at that amount of year-end cash can be found on the Cash Projection tab of your budget.

- Total Net Assets Without Donor Restrictions can be found under Major Assets. Here you can see the impact of your current years surplus or deficit on the overall net assets of the company.

More detail on your Net Assets can be can be found under the Equity section of the Balance Sheet.

Here you can see a detailed breakdown of the different types of Net Assets your company may have:

- Net Assets Without Donor Restrictions - Board Designated: The balance of any board designated funds your company may have in place.

- Net Assets With Donor Restrictions: The balance of donor restricted gifts that have been pledged to the organization. This number is primarily made up of gifts restricted for programs that have yet to occur or cross fiscal years and multi-year grants.

- Net Assets With Donor Restrictions - Permanently Restricted: The balance of any endowment funds or other permanent funds your company may have in place.

If you're having difficulty finding this information on your organization's budget, talk to your ArtsPool Financial Maintenance Lead about customizing your Notes tab to best fit your needs!

How did we do?