Becoming a member

Guide for members

Community guidelines

The basics

What ArtsPool does

What ArtsPool does: an overview

Financial Maintenance services

Financial Operations services

Workforce Administration services

Other services

Requesting changes to ArtsPool's scope of services

ArtsPool: an introduction

Training quick links

Requesting work from ArtsPool

Suggested titles, descriptions, and content for tasks

Requesting digital signature processing for a document

Share important events or deadlines with ArtsPool's calendar

Membership communication guide

New hire onboarding

Submitting a new hire task in the ArtsPool app

Guidance on creating offer letters

Employee benefits data management

Employee Payroll Setup: A to Z Guide

Independent Contractor and Employee Definitions

Paying employees

Paying Employees and Approving Payroll

Employee reimbursements

Processing per diem

ArtsPool Retirement Plan

Actors Equity Payroll with a PEO

Revenue and expenses

Managing petty cash

How to submit receipts to ArtsPool

Submitting bank deposits

How to code expenses and respond to clarification requests

Requesting payment for a bill

Xero-compatible check stock

Grants and contributions

Managing your NY State Grants Gateway prequalification

Requesting a grant budget or financial report

Corporate insurance

BeyondPay training

General BeyondPay training

Updating your BeyondPay password

Homescreen: Understanding My Personal Info

Changing your name with ArtsPool

Homescreen: Understanding My Actions

Homescreen: Understanding My Forms

BeyondPay training for employees

BeyondPay training for payroll admin

Accessing reports in BeyondPay

Unlocking employee accounts in BeyondPay

Verifying I-9 Forms

Approving timesheets in BeyondPay

Understanding payroll and BeyondPay

BeyondPay: approve time entries

Homescreen: Understanding Employee Management

Submitting Timesheets

Submitting and approving employee time off requests

Uploading and downloading an employee document in BeyondPay

Payroll FAQs - a troubleshooting guide

Downloading Pay Statements

Submit time off request in the ArtsPool app

BeyondPay mobile app

Download W2 from payroll

Paying independent contractors

Compliance

SAM.gov: The Federal System for Award Management

Providing annual sexual harassment prevention training and materials

Understanding conflict of interest disclosures

Board actions for New York nonprofits

Understanding corporate policies

Fiscal control stopgaps: what NOT to do

How to read a balance sheet

Technology

The ArtsPool app

Managing your ArtsPool app user account

Getting started with tasks

Working with your task list

Searching for tasks

Commenting on a task

Adding a document to a task

Adding people to tasks

Member pages in the ArtsPool app

Feature requests

Keyboard shortcuts

Reassigning requests

Tasks and privacy

Approving a batch of requests

Google Drive

Setting up a Google account

Google Drive tips and tricks

Syncing Google Drive files to your desktop

Exporting a Google Sheet to PDF

Getting started with Google Sheets

Migrating data between Google Apps accounts

Gmail

Email like a champ with Gmail keyboard shortcuts

Submit tasks at lightning speed with email templates

Creating a Gmail filter

Adding a forwarding address to Gmail

Security

Data security guide for members

Security on macOS

Data Security Policy

1Password account setup

1Password account management

1Password basics

Importing passwords into 1Password

Privacy Policy

Other technology resources

Working with documents

Accessibility statement

Governance and other goodies

Governance

Service agreements

Summary of changes to Terms of Service

Terms of Service

Dispute and Indemnity Summary

Annex A: Pricing and Billing

Annex B: Member Service Contact List

Annex C: Member Services List

Annex D: Onboarding Procedures

Annex E: Operating Agreement

Annex F: Privacy Policy

Annex G: Data Security Policy

Annex H: Limitations of Liability and Indemnification

Annex I: Dispute Resolution

Annex J: Improvement Process for Members not in Good Standing

Annex M: General Legal Provisions

Annex K: Termination Provisions

Annex L: Offboarding Procedures

Annex N: Defined Terms

External partners and vendors

Guidelines for a Successful ArtsPool-Auditor Partnership

Selection of vendors, consultants, software, and tools

How to choose software

Professional development resources

ArtsPool Operations Manual

- Knowledge Base

- Guide for members

- New hire onboarding

- Submitting W4 and state withholding forms in BeyondPay

Submitting W4 and state withholding forms in BeyondPay

Updated

by Julie Alexander

In order to set up your tax withholding information, you’ll need to complete a Form W-4 and any applicable state withholding forms through BeyondPay.

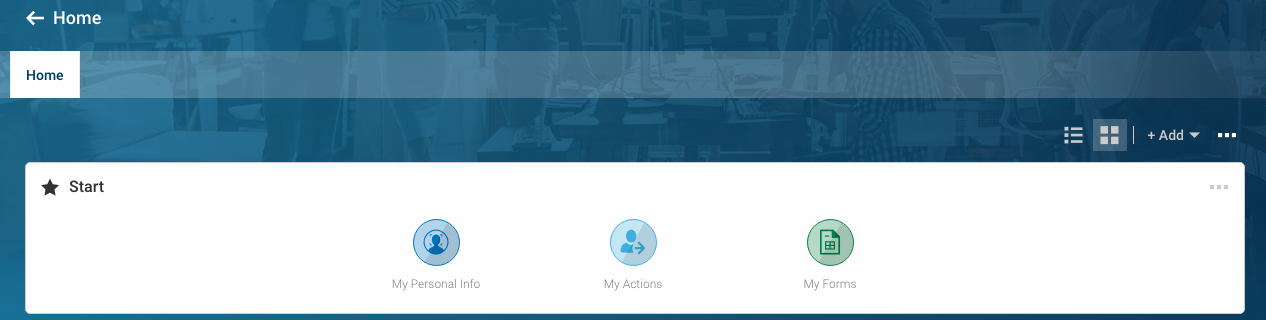

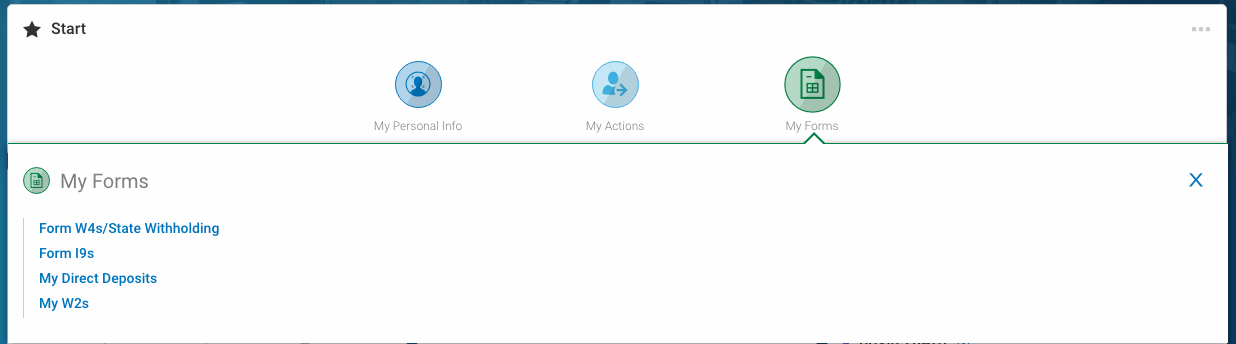

- First, go to the My Forms box on the far right of the screen.

- Click on the Form W4s/State Withholding link in the box.

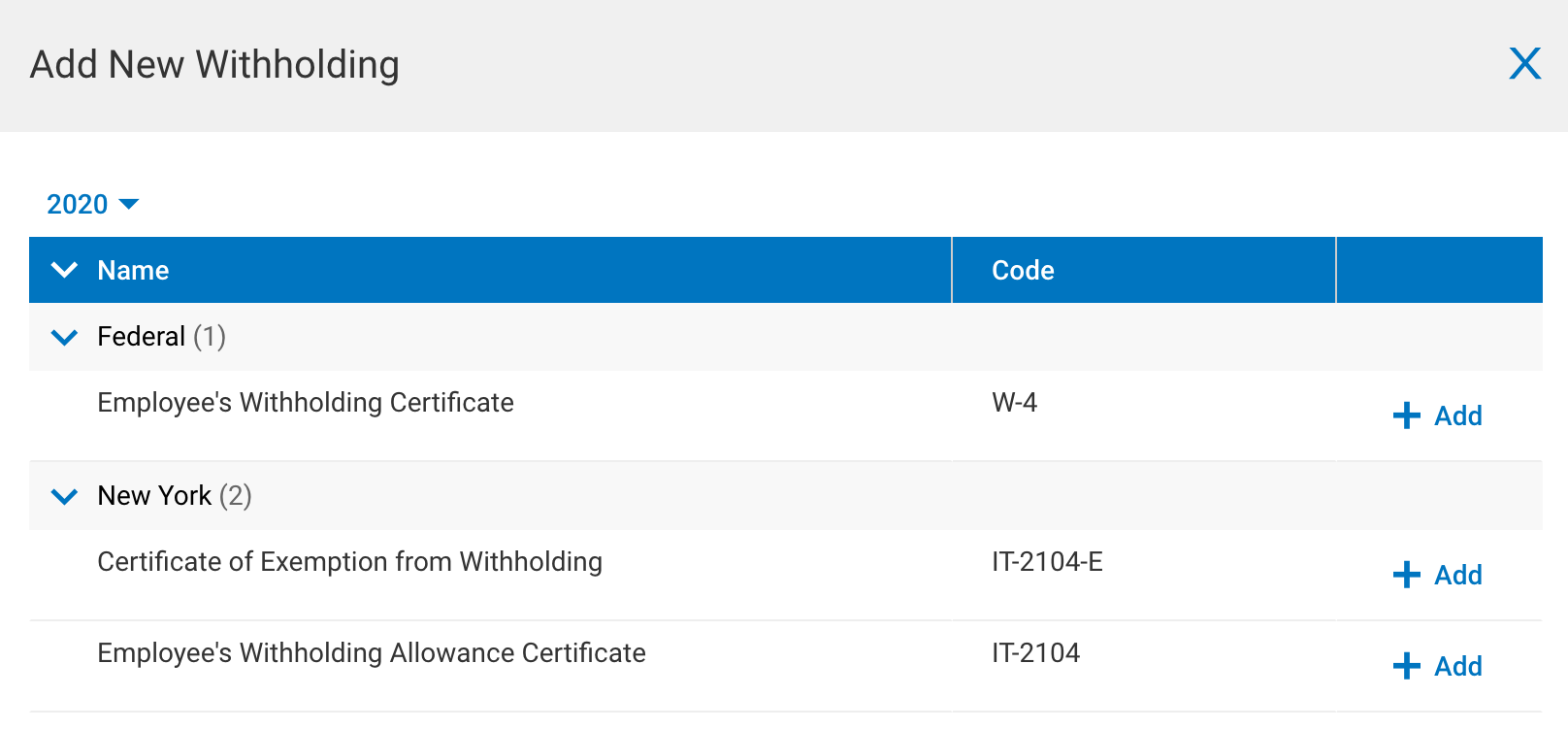

- Click on the ADD NEW on the top right to create new forms.

- You'll see a list of required forms - W4 is required for federal withholding, and a state withholding form will also populate based on your home address in your profile. For a New York state resident, you will need to fill out the W4 and IT-2104. Only fill out the IT-2104-E if you are claiming exemption.

- Fill in the required information in the forms, and click on the SUBMIT button on the top right, and you will be prompted to enter your password to e-sign the forms.